Clearway Energy Inc

Aktuelle Nachrichten

Abonniere den Newsletter

Kein Spam, Benachrichtigungen nur über die neuesten Nachrichten.One of the strongest secular trends that the world is facing right now is the adoption of renewable energy sources for our future. You have probably seen governments and businesses around the world make announcements on target dates to reach carbon neutrality. As investors, these secular trends provide excellent investing opportunities for the future, especially for something as widely adopted as renewable energies. Clearway Energy (NYSE:CWEN) is a multi-faceted clean energy company that designs, produces, and maintains renewable energy projects around the United States. Learn more

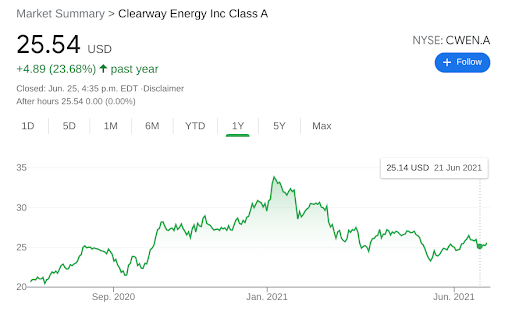

Clearway trades on the New York Stock Exchange and currently has a market cap of just under $5.3 billion USD. Its stock has a similar trajectory to many clean energy companies this past year, as shares surged in January of 2021, when President Biden was elected into office. From there, the stock has tumbled to its current share price of $26.55 at the time of this writing, which is about a 30% discount from its 52-week high price of $37.23. Can Clearway return to these levels in the near future? Let’s take a look.

Clearway Energy Stock Analysis: The first thing to note about Clearway Energy is that it does its business primarily within the United States. While theoretically this opens the door for international expansion in the future, it also caps their upside in the short-term. Expanding into other countries and continents takes time and planning, so any sort of growth would be in the long-term future. Across its portfolio of wind and solar projects, Clearway operates 9GW of energy per year across sites in 32 different states.

Clearway separates its customers into three distinct segments: utilities, business and government, and residential. As far as its business partners go, Clearway’s renewable energy infrastructure provides energy to the A-list of global companies including Toyota, Whirlpool, Deere and Company, MGM Resorts International, Whole Foods, and several high profile Universities around the country.

Most recently, Clearway has made significant progress in establishing two solar energy storage sites in Hawaii. The energy that is stored and created on site will be able to power over 45,000 houses on Oahu alone! Clearway also has other upcoming projects currently being developed on sites like New York’s Hudson community solar park, the Illinois community solar at Northwestern University, and the Black Rock wind farm in West Virginia.

Clearway states that it helps its customers eliminate over 8 million metric tons of carbon per year, a number that should only continue to rise in the future. The one thing that keeps rearing its head is the fact that Clearway has thus far refused to expand internationally. Most clean energy companies have at the very least moved into Canada by now, so Clearway’s insistence on staying stateside is confusing. Like we mentioned, a refusal to expand outside of its current market is a bearish outlook long-term, and most certainly caps the upside of the company in the short-term, even if it is one of the largest providers of clean energy in the country. Clearway has a high institutional investor base with over 90% of its shares held by institutions. The stock also pays a healthy 4.92% dividend yield annually, so if anything it is a safe investment with limited short-term upside.

Teilen

Über den Autor

Francesco Zen